Solutions

Transforming Financial Challenges into Opportunities

Challenges Facing Seniors

The Current Financial Landscape for Canadian Seniors

Seniors in Canada face growing pressures that threaten their financial stability and independence.

Rising Costs of Living

Inflation is hitting seniors hard. With fixed incomes and pensions like CPP and OAS failing to keep up, everyday expenses such as groceries, utilities, and housing are becoming unmanageable

Healthcare Expenses

Medical costs are a significant burden for aging Canadians. From prescription medications to long-term care, these expenses can deplete savings quickly without proper planning

Financial Scams

10% of Canadian seniors experience financial fraud annually, losing their hard-earned savings to scams targeting their vulnerability.

Complex Government Programs

CPP, OAS, GIS, and CRSP are vital programs, but they can be difficult to navigate. Many seniors miss out on benefits simply because they don’t understand how to access them or optimize their use.

Uncertain Investment Landscape

Market volatility can put retirement savings at risk. Without the right strategies, seniors may struggle to grow or protect their investments.

How the VIVA Leading Tech PFM Platform Can Help You

Our platform is designed to simplify personal financial management for seniors. With intuitive tools, AI-powered insights, and real-time support, we help you navigate rising living costs, manage healthcare expenses, and safeguard your future.

Core Features

Tools for government benefits

- CPP: Use our calculator to estimate monthly benefits based on your contributions and retirement age.

- OAS: Determine your eligibility and explore how to increase your benefits.

- GIS: Calculate additional income support for low-income seniors.

- CRSP: Plan your withdrawals strategically to minimize taxes and maximize savings longevity.

Budgeting and Expense Management

- Create a customized budget based on your income and spending habits.

- Get alerts on overspending and tips for saving.

- Plan for large expenses, such as travel or home repairs, with confidence.

Inflation Prediction Tool

- Our AI analyzes trends to predict inflation and its impact on your finances.

- Adjust budgets proactively to ensure stability, even as costs rise.

Fraud Prevention and Protection

- Monitor transactions for suspicious activity.

- Receive real-time alerts to stop scams before they happen.

- Access educational resources on recognizing and avoiding fraud.

Healthcare Cost Forecaster

- Predict medical expenses based on historical data and personal health factors.

- Allocate savings to prepare for future healthcare needs.

Investment Guidance

- Receive tailored advice on low-risk investment strategies.

- Protect your savings while maximizing potential returns.

Platform Development Process

Data Collection and Preprocessing

Focus on collecting financial data from Canadian seniors, including income, expenses, and investments.

- Data sources: Financial institutions (banks, pension funds), government assistance programs (CPP, OAS, GIS), and personal finance applications.

- Types of data:

- Income: Pensions, social assistance, investments.

- Expenses: Utilities, healthcare, food, and leisure.

- Investments: Stocks, mutual funds, and other assets.

Clean, normalize, and create new features from raw data

- Data cleaning: Eliminate invalid, missing, or duplicate entries.

- Normalization: Standardize financial values (e.g., currency, time units) for consistency.

- Feature creation: Develop metrics like “Healthcare expense ratio” to analyze financial resilience.

Ensure compliance with data privacy regulations.

- Adhere to PIPEDA in Canada to safeguard user data privacy and security.

- Employ encryption and store data on secure servers.

Model Selection and Training

Employ recurrent neural networks (RNNs) to capture time series patterns in financial data.

- Why RNNs: Ideal for analyzing time-series financial data (e.g., spending or investment history).

- LSTM and GRU: Improve the retention of long-term dependencies, minimizing information loss in lengthy sequences.

Develop models that can predict spending trends based on big data.

- Forecast healthcare costs, utility bills, and recurring expenses.

- Support efficient budgeting and saving strategies.

Continuously evaluate and refine the model to ensure optimal performance.

- Continuous learning: Update models with new data for ongoing improvements.

- Performance metrics: Accuracy, Mean Squared Error (MSE), and stability are key benchmarks.

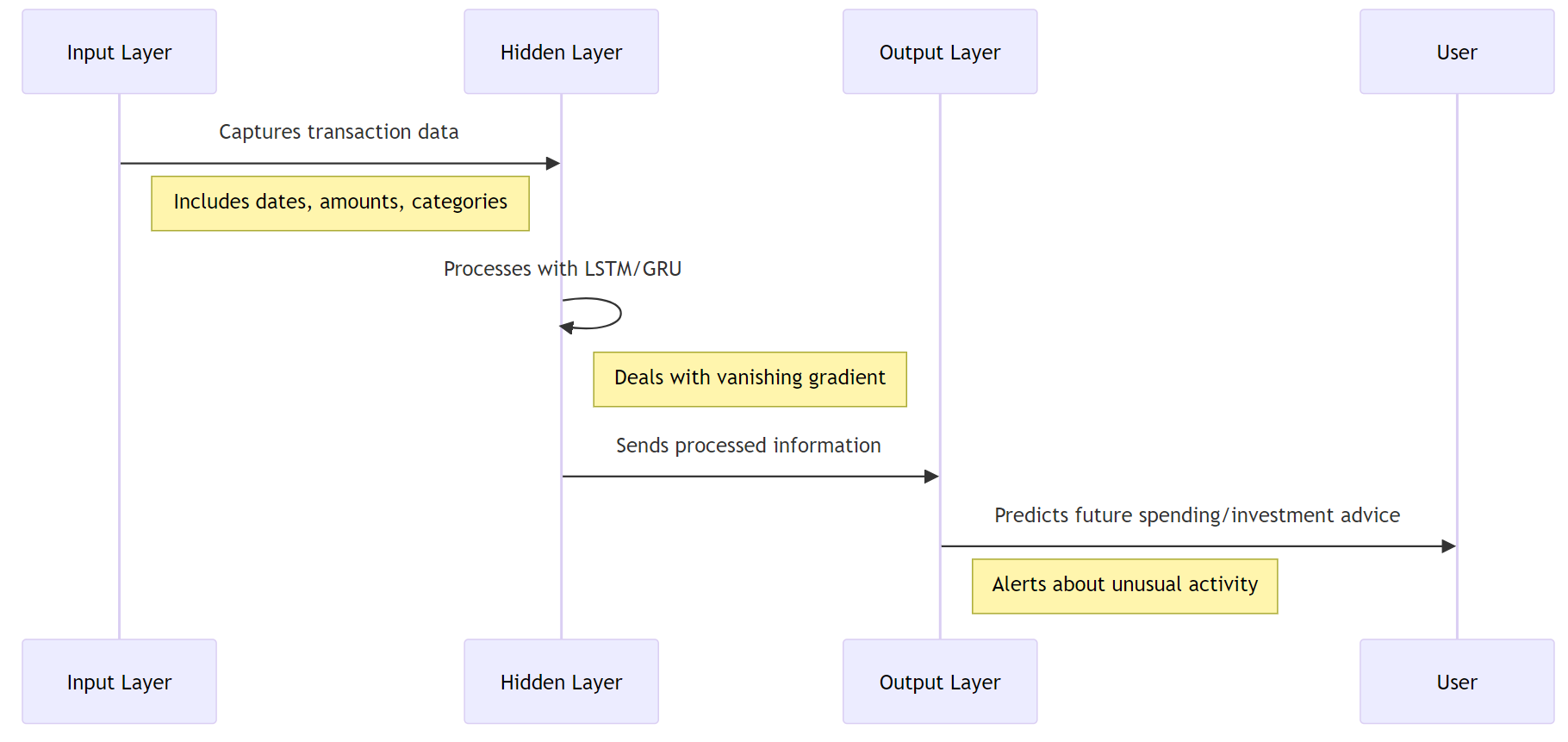

Flowchart illustrating the deployment of a RNN model into a PFM platform for Canadian seniors

Model Architecture Design

Build an RNN architecture suitable for financial forecasting for seniors.

- Design an RNN model (LSTM/GRU) tailored for analyzing time-series financial data of seniors, such as recurring expenses and pensions.

Utilize input, hidden, and output layers to process and predict data.

- Input Layer: Processes transaction data (amount, date, category).

- Hidden Layers: Analyzes patterns and trends over time.

- Output Layer: Provides spending forecasts or fraud alerts.

Tune hyperparameters to optimize model performance.

- Optimize hidden layers, learning rate, and batch size using grid/random search.

- Apply dropout techniques to prevent overfitting.

Model Validation and Testing

Evaluate the model on an unseen dataset to ensure generalization capabilities.

- Use a test set to ensure the model can make accurate predictions on real-world data.

Compare model predictions with real-world data.

- Example: Compare predicted monthly healthcare expenses with actual user spending.

Ensure the model is robust and efficient under various conditions.

- Test the model under different scenarios, such as sudden spending spikes.

- Assess computational speed and efficiency under heavy loads.

Understanding the Target Audience

Conduct in-depth research on the needs, behaviors, and financial habits of Canadian seniors.

- Conduct interviews and surveys with seniors to uncover:

- Challenges with healthcare costs.

- Needs for investment advice and savings plans.

- Comfort levels with technology.

Design the platform's interface and features to cater to this demographic.

- Intuitive interface with larger font sizes and high-contrast colors.

- Integration of voice commands and instructional videos.

Ensure the model provides useful and understandable information to users.

- Avoid complex financial jargon.

- Present concise, easy-to-understand financial reports.

Setting Clear Objectives

Define specific goals for the PFM platform (e.g., investment advice, fraud detection).

- Investment advice: Suggest safe and effective strategies.

- Fraud detection: Protect user assets from financial scams.

- Spending predictions: Aid users in budgeting and resource allocation.

Design the model and platform features to meet these objectives.

- Develop AI-powered chatbots for instant support.

- Include reminders and notifications about financial health (e.g., overspending warnings).